Financial Mortgage

THE SMARTER WAY TO BORROW

An introduction to the most revolutionary product in home finance.

What makes Financial Mortgage different from the rest?

- Faster Principal Paydown

- Reduced Monthly Interest Payments

- Access to Equity Dollars without Refinancing

- Savings without a Change in Lifestyle or Budget

- Most Americans need to rely on financing to buy/maintain real estate.

- Mortgages can add half the amount borrowed to a home's original price.

- Mortgage debt in America is an estimated $10.7 Trillion in just principal.

- 48.1 Million households owe a mortgage. That's 67% of homeowners.

Your Wealth is Trapped

in Your Mortgage

Don’t spend your entire life working to pay off your home. Conventional Mortgages have stayed the same since 1938, keeping borrowers in debt for too long.

Replace your Mortgage with a smarter loan. Stop wasting your money on costly mortgage interest when you change the way your payments are applied.

Where is your monthly mortgage payment going? Chances are the bulk of every monthly payment is going toward mortgage interest. When you’re spending all that money on interest, what are you losing?

Financial Mortgage gives you your financial freedom back.

What the Financial Mortgage Does for you:

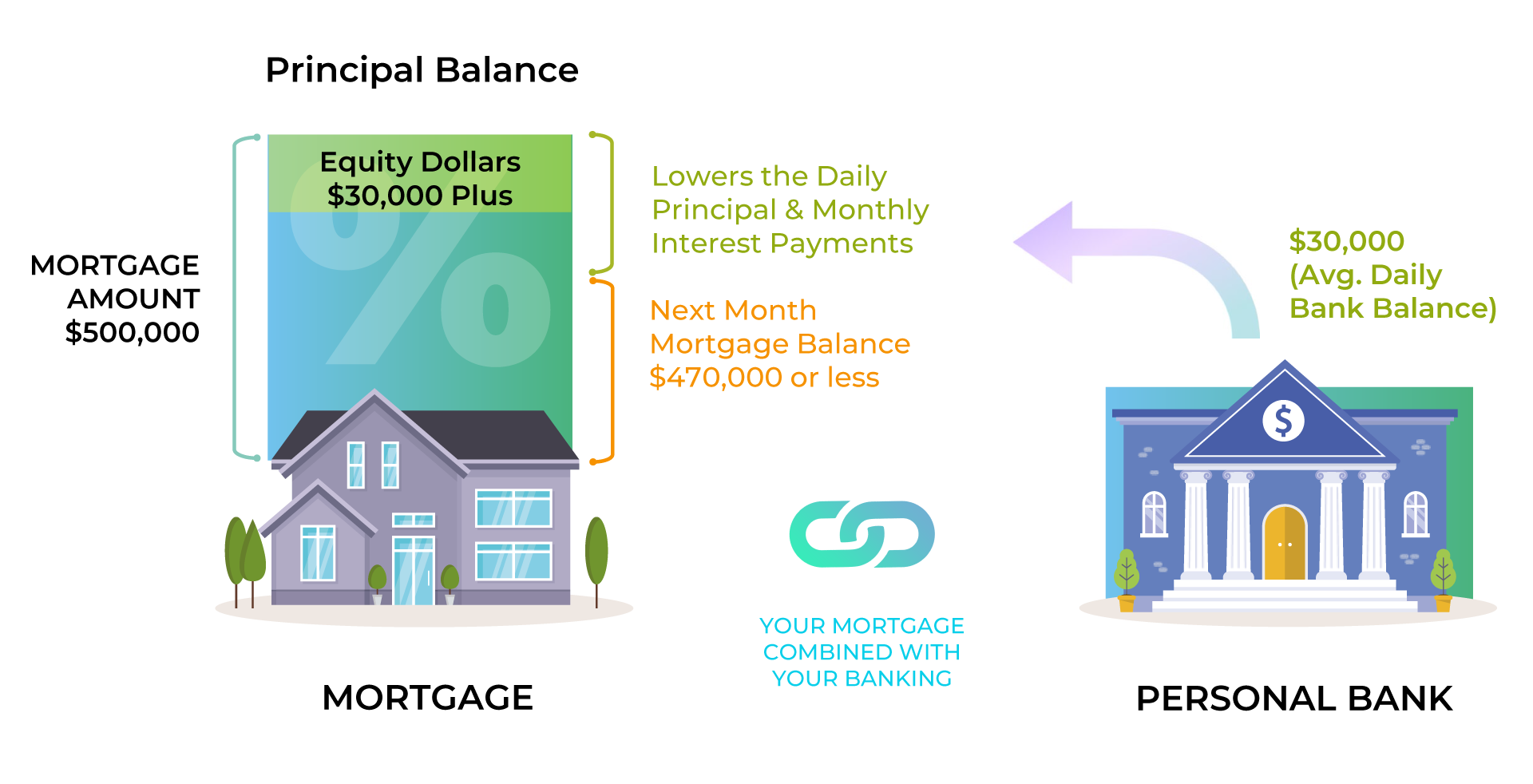

- Avoid unnecessary costs - when payments are applied to principal first, your loan’s interest is calculated on a lower loan balance.

- Pay off the home faster - with less money going toward interest, every monthly payment reduces your overall balance, faster.

- Lower overall debt - gives you back your financial freedom.

- Access home equity - it works like a checking account, withdraw money whenever you need it.

- A brighter financial future - with less money tied up in mortgage debt, you can save for retirement, send the kids to college, and afford unexpected costs and medical expenses.

Financial Mortgage - An Innovative Way to Borrow

* The illustration shown here is for education purpose only.

Sample Case List

| MORTGAGE BALANCE | CURRENT MORTGAGE | FINANCIAL MORTGAGE | INTEREST SAVED |

|---|---|---|---|

| $1,782,213 | Years to Pay-Off: 29.2 | Years to Pay-Off: 10.8 | $288,270 |

| $265,000 | Years to Pay-Off: 13.2 | Years to Pay-Off: 8.3 | $13,999 |

| $756,063 | Years to Pay-Off: 25.7 | Years to Pay-Off: 12.3 | $167,562 |

| $304,493 | Years to Pay-Off: 25.6 | Years to Pay-Off: 8.8 | $79,839 |

| $698,921 | Years to Pay-Off: 17.9 | Years to Pay-Off: 9.4 | $116,853 |

* Financial Mortgage disclosure: The financial mortgage is provided through our affiliated vendors/providers.

* The results shown here are for illustration and education purpose only. Same results are not guaranteed, and individual results may vary depending on income, expense, cash flow and other financial factors.

We asked our FINANCIAL MORTGAGE borrowers how this revolutionary mortgage loan has improved their financial flexibility. Here’s what they had to say:

| 9 | OUT OF | 10 |

customers report using the Financial Mortgage to save money compared to a traditional mortgage.

We are estimated to be paid off in 7 years originally. We have paid down by $131,670! I am super excited that we might have it paid off within the next 2-3 years. Love this loan!

- DEBORAH, OREGON

| 9 | OUT OF | 10 |

customers have recommended the FINANCIAL MORTGAGE to someone they know.

We have an investment property and leveraging the FINANCIAL MORTGAGE on our primary residence we were able to also save on our investment property. We do plan to purchase more properties in the future.

- JASPREET. CALIFORNIA

| 9 | OUT OF | 10 |

customers who have recommended the FINANCIAL MORTGAGE, have recommended it to 2 or more people.

We have all the security we need and that provides such peace of mind that I can sleep well at night knowing we’re covered, that is huge. Open your mind to more than just interest rates, this product is about so much more than just ‘what’s the rate?’

- ELLEN. SOUTH CAROLINA

| 3 | OUT OF | 10 |

customers who have recommended the FINANCIAL MORTGAGE, have recommended it to more than 5 people.

Once I learned about the product, I was all in (no pun intended) I’ve had some unexpected expenses come up and I’m getting married soon. I feel I’ll be back on track in no time. My soon to be wife and I are already looking at investment options with the savings we have using the FINANCIAL MORTGAGE..

- LUKE, CALIFORNIA

| 9 | OUT OF | 10 |

customers report using the Financial Mortgage to save money compared to a traditional mortgage.

We are estimated to be paid off in 7 years originally. We have paid down by $131,670! I am super excited that we might have it paid off within the next 2-3 years. Love this loan!

- DEBORAH, OREGON

| 9 | OUT OF | 10 |

customers have recommended the FINANCIAL MORTGAGE to someone they know.

We have an investment property and leveraging the FINANCIAL MORTGAGE on our primary residence we were able to also save on our investment property. We do plan to purchase more properties in the future.

- JASPREET. CALIFORNIA

| 9 | OUT OF | 10 |

customers who have recommended the FINANCIAL MORTGAGE, have recommended it to 2 or more people.

We have all the security we need and that provides such peace of mind that I can sleep well at night knowing we’re covered, that is huge. Open your mind to more than just interest rates, this product is about so much more than just ‘what’s the rate?’

- ELLEN. SOUTH CAROLINA

| 3 | OUT OF | 10 |

customers who have recommended the FINANCIAL MORTGAGE, have recommended it to more than 5 people.

Once I learned about the product, I was all in (no pun intended) I’ve had some unexpected expenses come up and I’m getting married soon. I feel I’ll be back on track in no time. My soon to be wife and I are already looking at investment options with the savings we have using the FINANCIAL MORTGAGE..

- LUKE, CALIFORNIA

What are the steps?

5 Step Process

- Fill out the checklist form

- Assessment within 7-10 business days

- Presentation

- Send Application

- Complete with the Loan Company

Frequently Asked Questions

Deposits are swept nightly to the HELOC-side of the account and applied to loan principal.

This makes higher use of idle money in order to save monthly interest expenses on the mortgage before it’s spent.

Deposited cash and home equity dollars become one and remain available for use 24/7 over the 30-year term of the

HELOC. Money can be accessed through the ATM-VISA cards by writing checks or paying bills and transferring funds

online through the lender bank portal and your mobile device.

The Financial Mortgage is a 30-year home equity line of credit with an integrated sweep-checking account. The credit

limit is established in underwriting and is based on borrower qualifying characteristics. The limit remains unchanged

for the first ten years then steps-down each month by 1/240th for the remaining 20 years until it reaches $0.

It is up to you! There is no payment schedule to hold you back. Financial Mortgage clients typically eliminate more

than 10% of their principal balance annually and are on track to be paid off in half the time or less compared to a

traditional mortgage.

Ask your Financial Mortgage Professional and scheduled webinars.